Entrepreneurial Bookkeeping

Part 1 | Balance Sheet and Reconciliation

Balance sheets are a type of report that helps you stay aware of where money is coming and going in your business. We don’t use balance sheets a lot in our businesses, but they do help make it clear if the money you’re spending on yourself is coming from actual profit or if you’re relying on credit card debt too much.

There’s nothing necessarily wrong with debt, but if most of the money you’re making ultimately comes from debt, you’re probably not making as much revenue as you think. Using a balance sheet can help you spot this issue early, before it grows into a much bigger problem.

Balance sheets in coaching businesses are usually very simple. They’re most often broken up into three categories:

- Assets: Anything that is either cash or can be easily turned into cash. Checking accounts, PayPal accounts and similar things that function like cash fall under this heading. Some companies put stocks here too, as these can be easily converted into cash. To keep things simple, any account with a positive amount in it goes here.

- Liabilities: Anything that counts as a debt, like credit cards balances. Any account with a negative amount in it goes here.

- Owner equity: Whenever you put something into or take something out of your business, it shows up in this section. More simply, this is any money used that doesn’t come from the sale of products or services. This section covers owner distributions, capital contributions, retained earnings (all the cash left in the business at the end of last year that wasn’t taken out), and owner’s personal taxes (actually a different kind of owner distribution).

One number you can check on your balance sheet to give you a quick impression of the health of your business is the total left when you subtract liabilities from assets. If this number is above zero, you can feel pretty good about how things are going. If that isn’t the case, this isn’t necessarily bad, but it does tell you that if it stays that way over time, you may be taking on more debt than you have revenue to cover. It’s important to be aware of this to avoid problems later.

Reconciliation

Reconciliation is a process in which you bring all of the transactions from your clients’ accounts together into your accounting software and check them for accuracy. These transactions are organized and labelled (which some accountants call “coding”), then checked against your bank account to make sure they match. The balance you calculate in your software and the balance in your bank account should match perfectly, down to the penny. If you don’t reconcile at this level, there’s a good chance that your P&L reports and balance sheets will be inaccurate, which can cause problems when you need an accurate sense of how your business is doing.

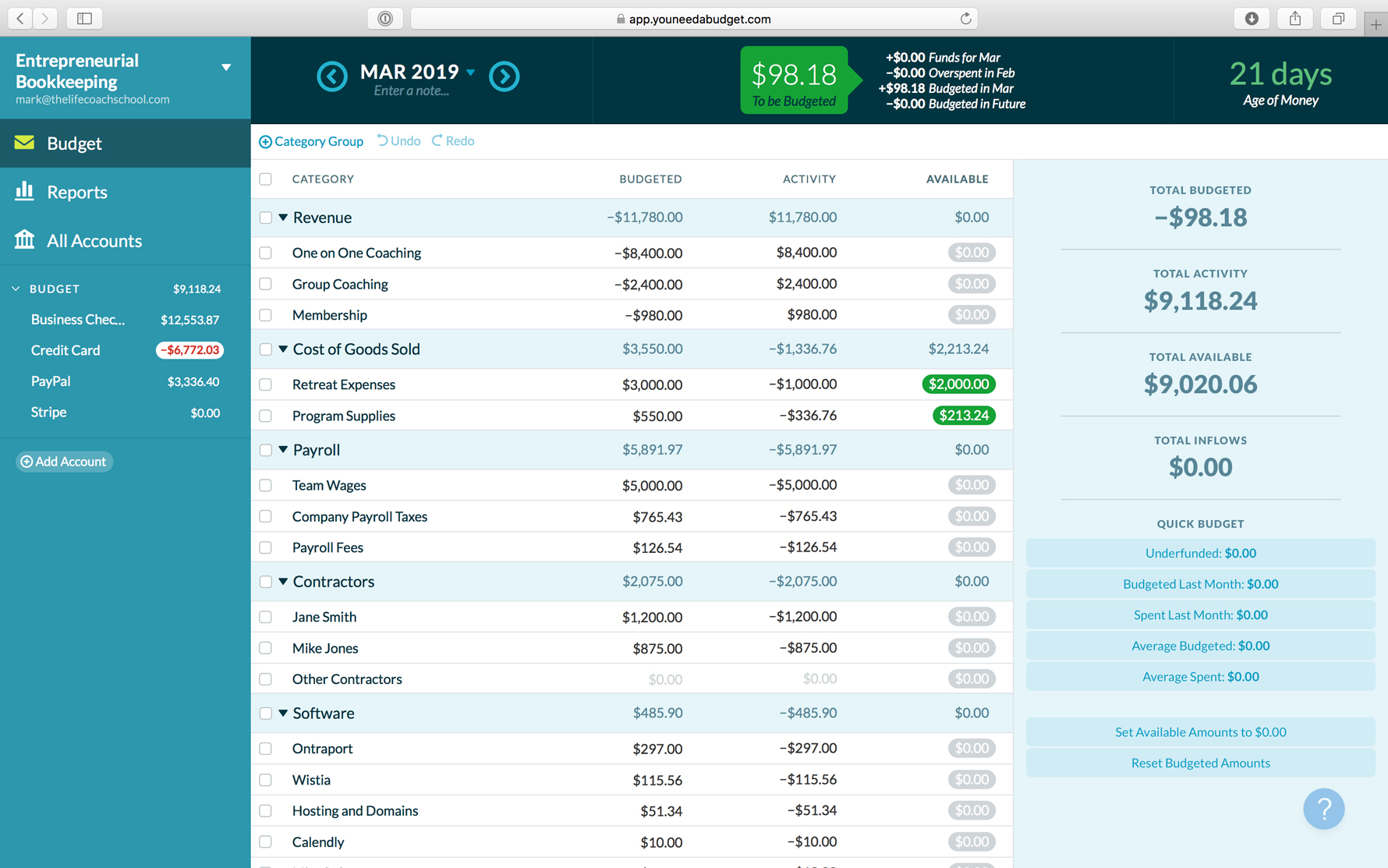

We strongly suggest that you do this a lot. Reconciling monthly is the minimum we’d recommend, but you can do it more often if you want to, or if your business needs it. There’s no such thing as too often. Some business owners even do theirs daily. There isn’t really some minimum number of transactions or amount of revenue where we think you should do it more often, either. If you do this right from the start of your business, you can rest easy, knowing your books are perfectly accurate. The actual software you use isn’t very important. Some people use QuickBooks, and we use You Need a Budget; both are good for your needs here. That you do it frequently and consistently is much more important.

There are a lot of good reasons for doing frequent reconciliation. As mentioned above, it ensures that your reports are accurate, helping you stay on top of the health of your business and get out ahead of problems. It also helps you make sure that you received the money you’re owed before too much time passes. If you have to go back to a client after several months to explain that a card processing problem means that they didn’t pay you, it creates an awkward situation and makes you seem unprofessional. If it’s been too long, you might not be able to get the money back at all, which could cost you a lot in the long run.