Entrepreneurial Bookkeeping

Part 1 | Proper Setup for Business Bookkeeping

In this module, we’ll walk you through setting up your business for proper bookkeeping. Before we get started, let’s take care of some basics.

Business Entities

The first step is to decide on a kind of business entity. There’s a lot to choose from, but we recommend that you form an LLC. Once you’re making several thousand dollars, you’ll then want to be taxed as an S corporation. This is exactly what we’ve done. You can read more about business entities and liability here. Click here to learn about business entities and taxes. You need to make sure that you’re protected and are taking advantage of all the tax savings open to you, so check in with your attorney and accountant as your business grows.

Business Accounts

A lot of people might want to ignore this part, but it’s important. You need to set up a separate checking account and credit card for your business. All of the expenses coming from your business can be written off against revenue, so you should make sure you keep separate records from the very first dollar you spend or make. We recommend using your business credit card or business checking account for all business purchases so that you have trackable payments. If you must use cash, make sure you take a photo of or scan the receipt for your records.

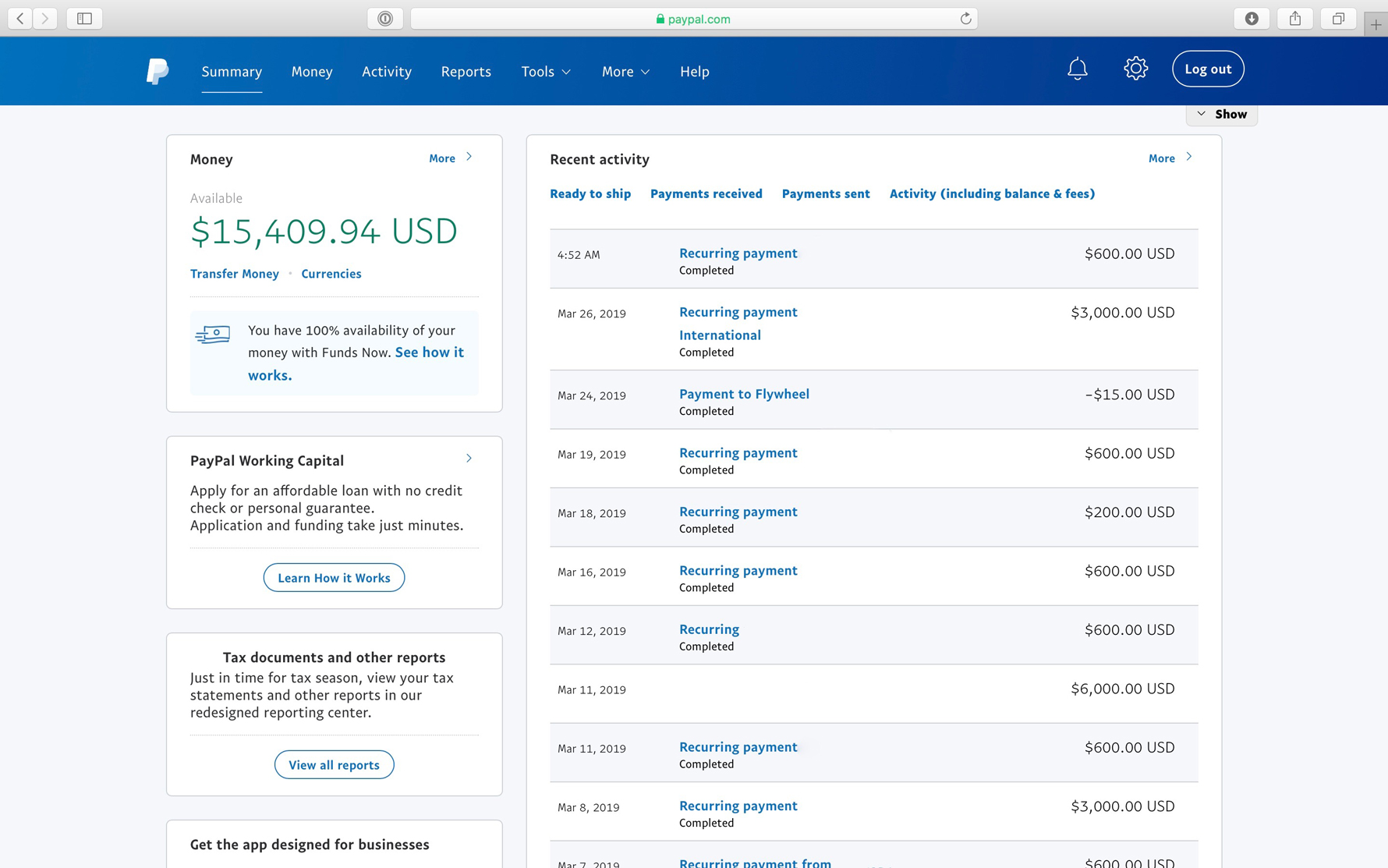

You’ll also need a merchant account to process payments. We recommend PayPal, Stripe, Gumroad or Authorize.Net for opening a merchant account. Take all the time you need to learn how these packages work and how to get the most out of them. We make some recommendations here, but it’s up to you to find the perfect fit for your company. At The Life Coach School, we use PayPal and Stripe for our merchant accounts and Ontraport as our processor.

Bookkeeping Software

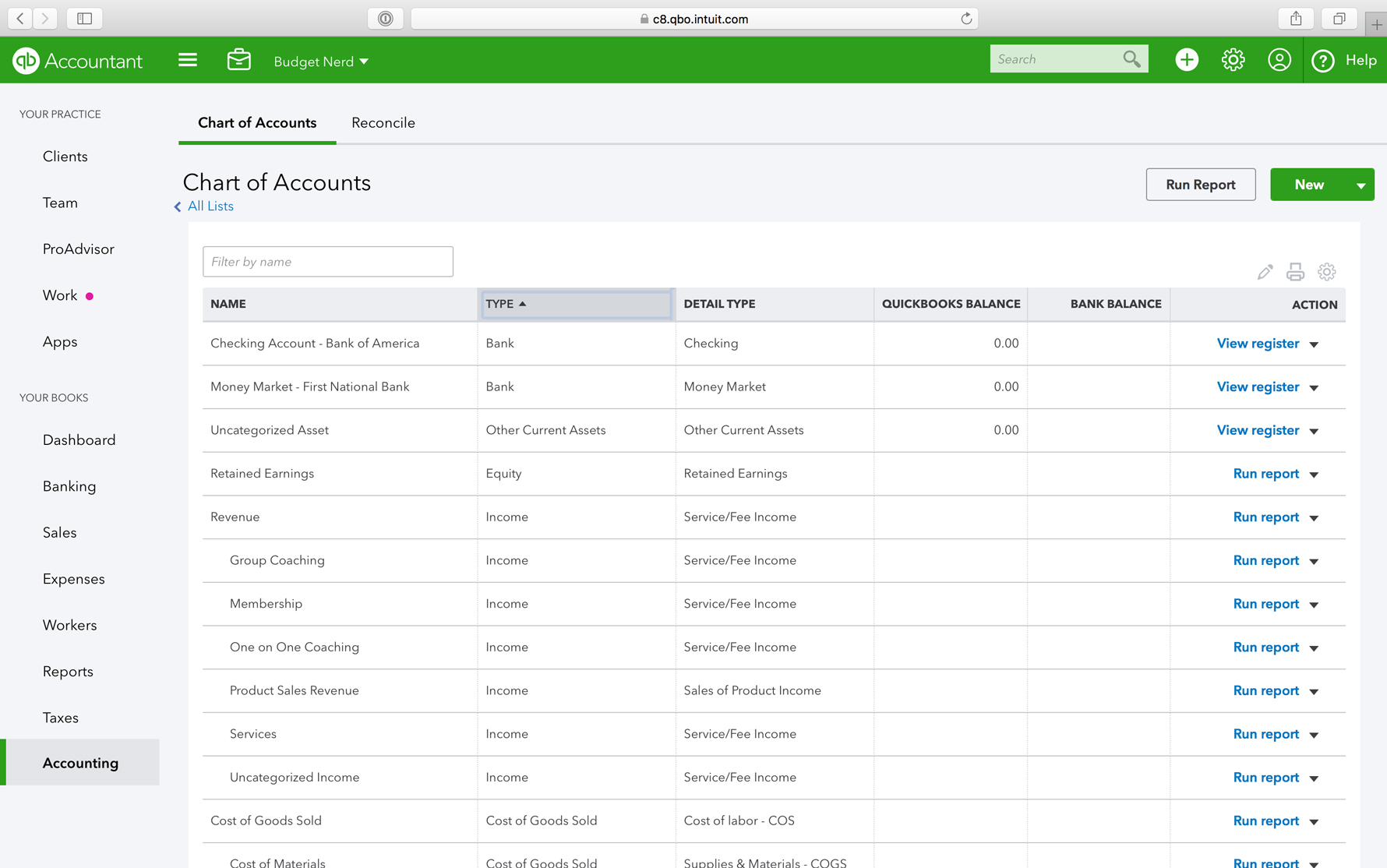

Rather than try to do all of your bookkeeping by hand, we really think you should use bookkeeping software. We recommend you check out QuickBooks, Xero and Bench. Just like with the merchant account and payment software, you should take as much time as you need to learn how one of these packages works. Even if you have a professional bookkeeper, it’s still useful to understand and use these software packages for basic reporting of income and taxes. You’ll also need to set up categories (labels that you give to any transaction happening in your business), and use categories that help you, rather than your accountant. We have a lot of detail in our categories and use non-traditional category names that are most useful to us personally. You can work with your accountant to make sure you set up categories that make sense for taxes and for you.

Accountants

Finally, you need to set up quarterly appointments to go over your finances with your accountant. Try not to put this off until it is time to file taxes or when you have a problem. If you only talk to your accountant once a year, you’ll miss out on valuable advice to reduce your tax bill.

It’s very important to have an accountant you like working with and who can help you with your specific needs. To get the best out of your relationship with your accountant, you should want to talk to them and make them a regular part of your team. At the same time, they should be happy to help you learn about the work they do and have a good understanding of the kind of business you run.

Though we really recommend regular meetings with your accountant, it’s also vital that you’re prepared for tax season. Your accountant will want reports in a certain format, so make sure you familiarize yourself with the balance sheet, the profit and loss report, and any other detailed report your accountant requires.